dollars for rupees, it’s a good idea to plan ahead. Individual merchants may also charge additional fees if you ask them to convert the price of an item into your home currency. For example, credit card processors and ATM networks typically charge a conversion fee that amounts to 1% of the purchase price. Keep in mind that converting currency usually comes with fees that a calculator probably won’t account for in its equation. Since currency conversion rates change on a daily basis, a calculator is a great way to ensure that your math is correct. Using a currency conversion calculator is the easiest way to get an estimate when you’re ready to exchange your funds. dollars to rupees is a fairly easy process.

US DOLLAR TO INDIAN RS HOW TO

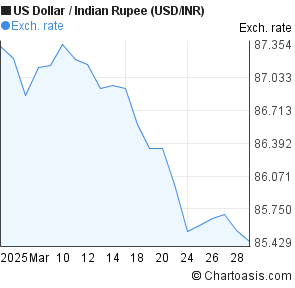

Much of the decline can be attributed to RBI's recent intervention and a rise in the cost of imported goods.Via Wise website How to convert US Dollars to RupeesĬonverting U.S. In October 2021, the country's foreign exchange reserves touched an all-time high of about USD 645 billion.

However, if you are travelling abroad for the first time, then it is important to know certain things about buying forex. 10 tips about buying forex you should know before travelling abroad for vacation May 12, 2023, 11:50AM ISTĪfter the novel coronavirus pandemic, many individuals are making plans to travel either in the country or in foreign places.India's forex reserves reached a 10-month-high of $588.8 billion in the week through April 28, recovering from a drop to $524.5 billion last October, when the rupee hit a record low against the U.S. India's foreign exchange reserves saw a rise of $7.196 billion to $$595.98 billion as on May 5, 2023, data from the Reserve Bank of India showed on Friday. India's forex reserves rises to 11-month high of $595.98 billion May 12, 2023, 05:11PM IST.

The central bank intervenes in the foreign exchange market to rein in excessive volatility in the exchange rate. India’s forex reserves surge to a 11-month high of $595.9 May 13, 2023, 10:34AM ISTĪnalysts said the Reserve Bank of India had taken the opportunity to build up its reserves amid weakness in the US dollar, which had eased pressure on emerging market currencies such as the rupee.

0 kommentar(er)

0 kommentar(er)